When storing Bitcoin, personal safety and security are paramount. While various storage options are available, the safest methods often inv...

When storing Bitcoin, personal safety and security are paramount. While various storage options are available, the safest methods often involve a combination of hardware solutions and best practices to mitigate risks such as hacking, theft, or loss. Here’s an overview of the safest ways to store Bitcoin personally:

1. Hardware Wallets (Cold Storage)

Overview: A hardware wallet is a physical device that securely stores private keys offline, ensuring they are not exposed to the internet or vulnerable to hacking.

Popular Hardware Wallets: Ledger Nano S, Ledger Nano X, Trezor Model T.

Pros:

- Immune to online hacking.

- Highly secure with PIN protection.

- Private keys never leave the device.

Cons:

- Physical device can be lost, stolen, or damaged (although backups can mitigate this).

Best Practices:

- Purchase directly from the manufacturer to avoid tampered devices.

- Set a strong PIN and recovery seed phrase.

- Store the recovery seed in multiple secure locations (never online)

.

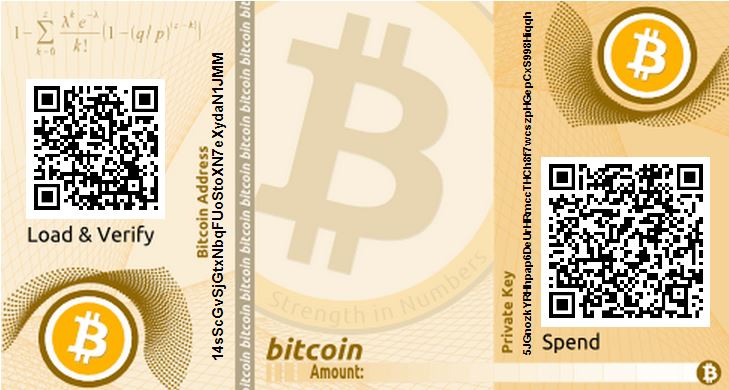

2. Paper Wallets

Overview: A paper wallet is a printed or written document that contains your public and private keys. It's completely offline (cold storage), which makes it highly secure from cyberattacks.

Pros:

- Completely offline and immune to online attacks.

- Simple to create and use for long-term storage.

Cons:

- Easily damaged, lost, or stolen.

- Inconvenient for frequent transactions.

- If improperly created (e.g., online generators), it can be exposed to malware or hacking.

Best Practices:

- Generate the wallet offline on a clean computer.

- Print on durable material and store in a safe location (safe deposit box, etc.).

- Make multiple copies and secure them in separate locations.

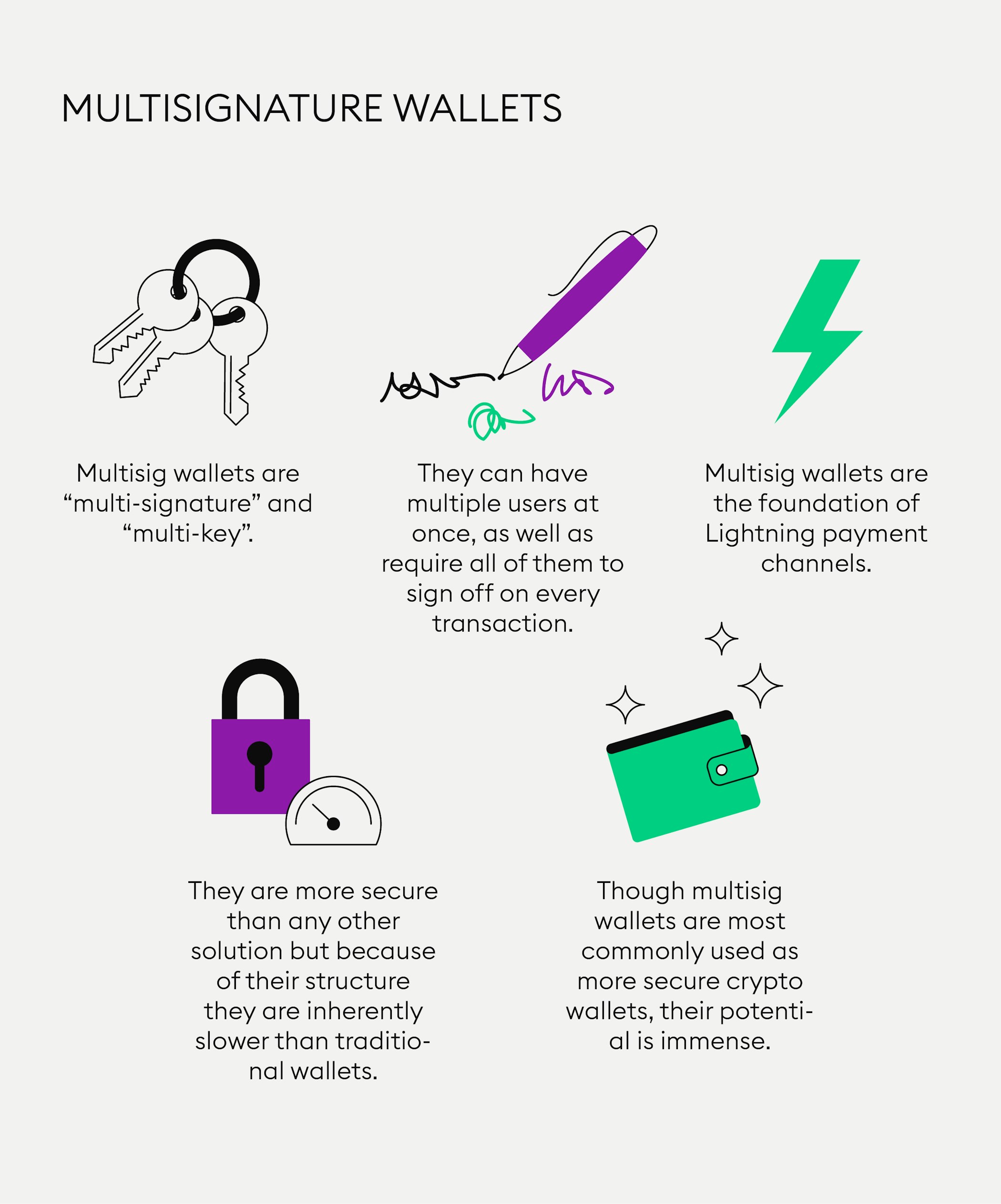

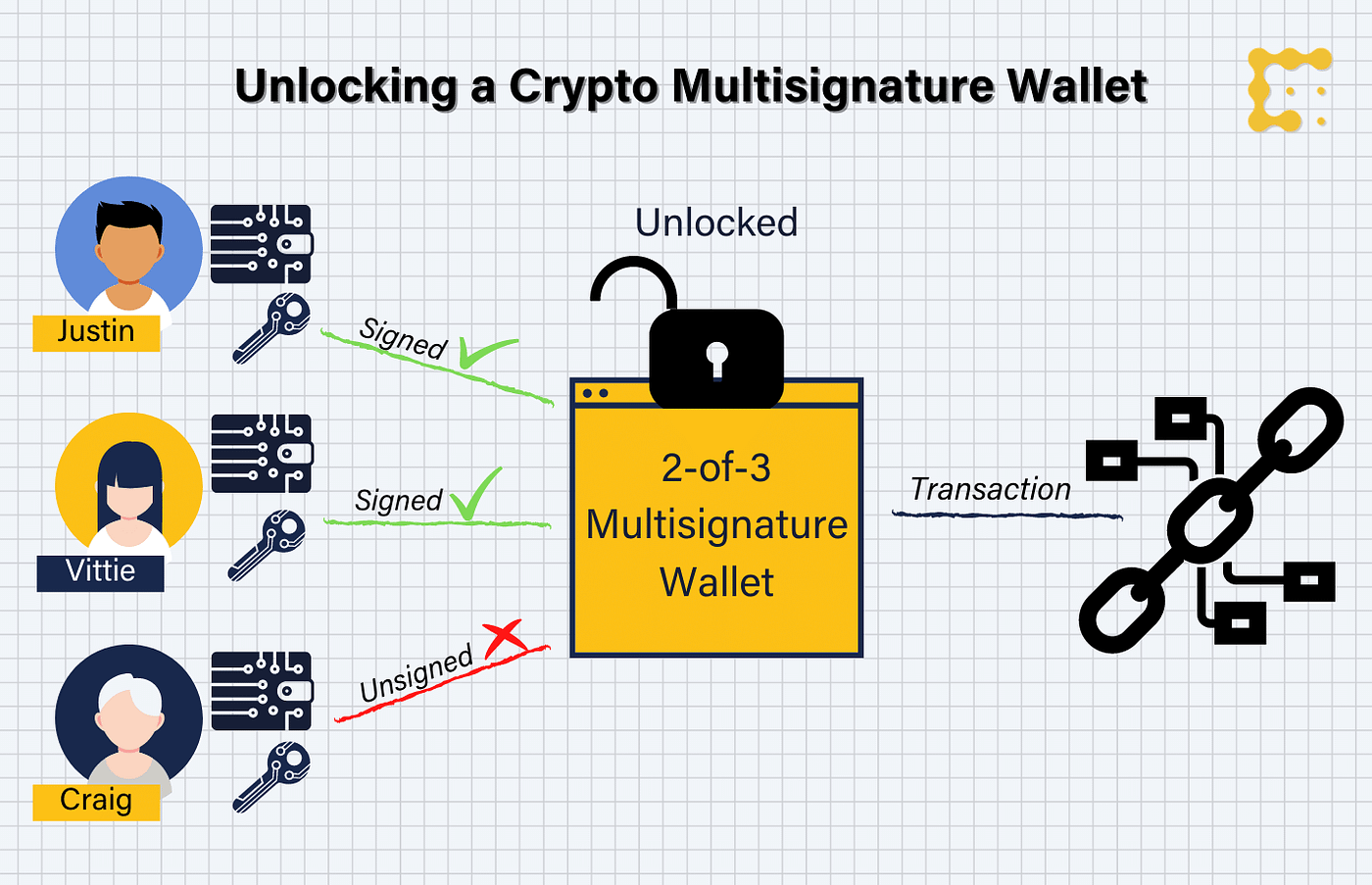

3. Multisignature (Multisig) Wallets

Overview: A multisig wallet requires multiple keys (e.g., 2 of 3) to authorize a transaction. This adds an additional layer of security, as no single entity controls all the keys.

Pros:

- Enhanced security by requiring multiple approvals for transactions.

- Reduces the risk of a single point of failure (if one key is compromised, the funds are still safe).

Cons:

- Slightly more complex to set up and manage.

- Requires careful management of all keys (distributed across different locations).

Best Practices:

- Distribute the keys securely, such as storing one in a hardware wallet, one in a secure vault, and one with a trusted third party.

- Ensure backup keys are kept in secure locations.

4. Software Wallets (Hot Wallets for Small Amounts)

Overview: Software wallets can be desktop, mobile, or web-based. While convenient for transactions, they should not be used to store large amounts of Bitcoin due to their vulnerability to hacking and malware.

Pros:

- Convenient for small amounts and daily transactions.

- Can easily access and spend Bitcoin.

Cons:

- Vulnerable to malware, hacking, and phishing attacks.

- Private keys are stored on a device connected to the internet.

Best Practices:

- Only use for small amounts of Bitcoin.

- Use two-factor authentication (2FA) and strong passwords.

- Regularly update the software and avoid using public Wi-Fi.

5. Encrypt Backups and Use Secure Locations

- Encrypt Your Wallet Backup: Whether it’s a hardware wallet recovery phrase, paper wallet, or software wallet backup, always encrypt the data before storing it.

- Secure Storage Locations: Store backups in multiple secure locations, such as a safe deposit box or a trusted family member's safe, in case of physical loss or damage.

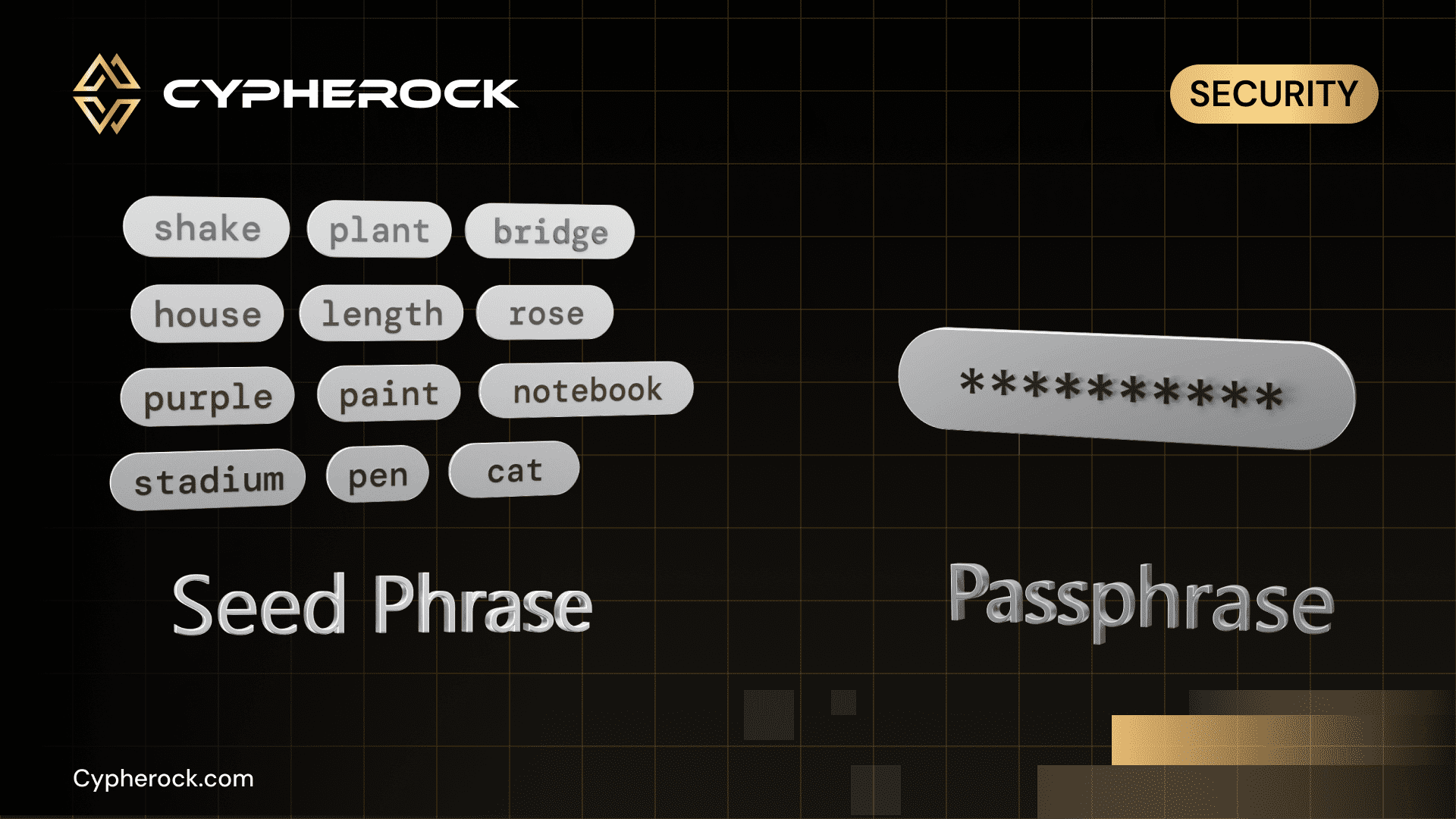

6. Consider a Passphrase for Extra Security

- Passphrase Protection: In addition to the seed phrase, many wallets allow you to add a passphrase, adding an additional layer of security. Be aware that if forgotten, the funds may be permanently inaccessible.

7. Avoid Cloud Storage or Screenshots

- Never store private keys or recovery phrases on cloud services like Google Drive, Dropbox, or email. These are prime targets for hackers.

- Avoid screenshots, which can be intercepted or backed up to the cloud without you realising.

8. Offline or Air-Gapped Devices

- Use an offline or air-gapped device (one that has never connected to the internet) for generating and managing private keys. This prevents any remote access or malware from compromising your keys.

9. Be Aware of Phishing Attacks

- Be cautious of fake websites or email scams that try to trick you into entering your wallet’s private keys or seed phrase.

10. Use Only Reputable Platforms for Exchanges

- While exchanges are not suitable for long-term storage, when buying Bitcoin, use reputable platforms that offer good security practices. Always transfer purchased Bitcoin to your personal wallet for safe storage.

Conclusion

For long-term and high-security storage, hardware wallets combined with multisignature setups or paper wallets are the best options. They provide the highest level of security by keeping your private keys offline. For smaller amounts or frequent use, software wallets or mobile wallets can offer convenience but should always be used with caution. Regularly reviewing your security measures, diversifying backup locations, and keeping your recovery seed secure are essential steps for protecting your Bitcoin.

No comments